The Vietnamese Funding Landscape in 2025

Vietnam’s startup ecosystem has emerged as one of Southeast Asia’s most dynamic innovation hubs, experiencing remarkable growth and transformation throughout 2024 and into 2025. After weathering the global funding winter of 2022-2023, Vietnamese startups have demonstrated exceptional resilience, attracting significant investment and establishing the country as a leading destination for venture capital in the region.

Market Recovery and Growth Trajectory

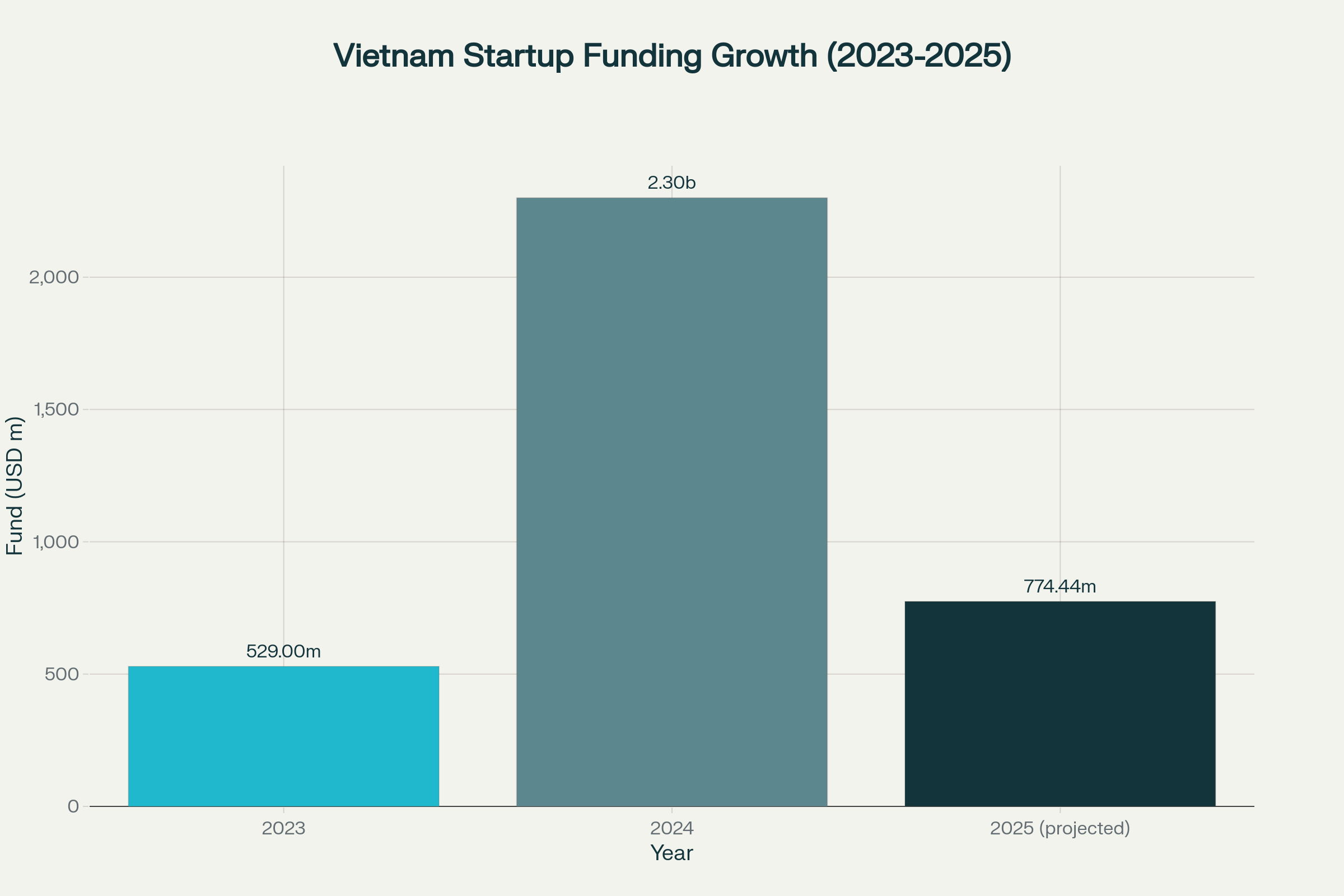

Vietnam’s funding landscape shows a compelling recovery story. Following a challenging 2023 that saw total startup funding drop to $529 million—a 17% decline from the previous year—the market rebounded dramatically in 202412. Vietnamese startups attracted an impressive $2.3 billion across 141 deals in 2024, marking a substantial recovery and renewed investor confidence in the market34.

Vietnam startup funding shows strong recovery in 2024 after 2023 decline

The funding resurgence reflects Vietnam’s strong macroeconomic fundamentals and strategic positioning in the global supply chain. With nominal GDP projected to exceed $1.1 trillion by 2035 and sustained economic growth of over 6% annually, Vietnam has created a robust foundation for startup investment3. The country’s demographic advantage—with a median age of just 33.1 years and over 70% internet penetration—provides an ideal environment for digital innovation and tech adoption56.

Leading Venture Capital Firms

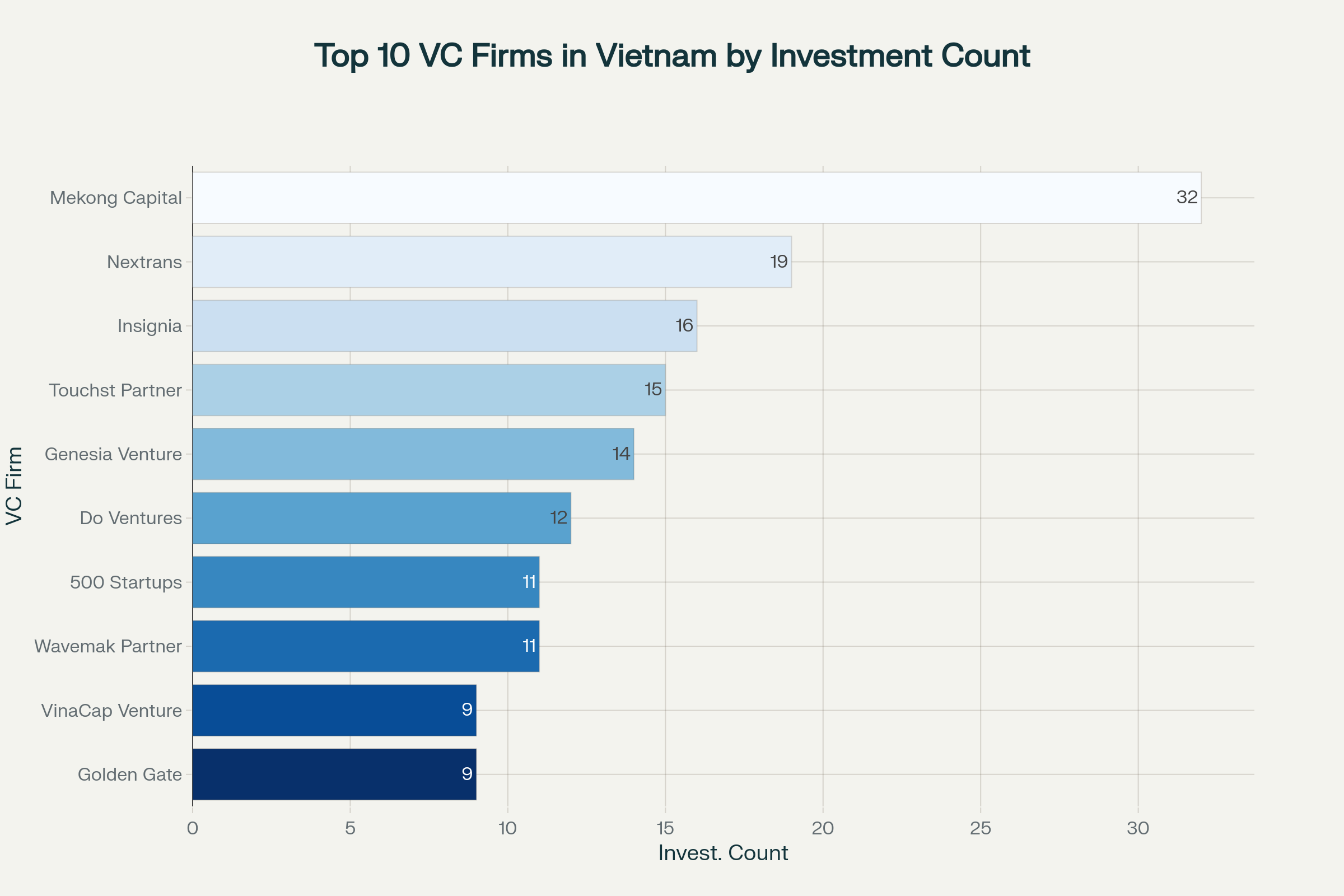

Vietnam’s VC ecosystem is characterized by a diverse mix of domestic and international investors, each bringing unique expertise and capital to the market. The landscape is dominated by established players who have built strong track records of successful investments in Vietnamese startups.

Mekong Capital leads Vietnam’s VC landscape with 32 local investments

Mekong Capital leads the market with 32 investments in Vietnamese companies, focusing primarily on consumer-driven businesses and private equity opportunities with investment ranges of $10-35 million78. The firm has established itself as a cornerstone investor in Vietnam’s growth story, particularly in retail, healthcare, and consumer finance sectors.

International presence remains strong, with Singapore-based firms like Insignia Ventures Partners and Genesia Ventures actively investing in Vietnamese startups. These regional players bring valuable cross-border expertise and access to Southeast Asian markets86.

Notable developments include the launch of VinVentures Capital Fund by Vietnam’s richest person, Pham Nhat Vuong, with $150 million in assets under management specifically targeting AI, semiconductors, and cloud computing startups9. This represents a significant commitment from domestic capital to support the local ecosystem.

| VC Firm | Vietnam Investments | Focus Areas | Investment Range |

|---|---|---|---|

| Mekong Capital | 32 | Consumer-driven businesses, PE | $10M - $35M |

| Nextrans | 19 | Early to growth stage | $1M - $15M |

| Insignia Ventures Partners | 16 | B2B, Enterprise tech | $1M - $20M |

| Touchstone Partners | 15 | Seed to Series A | $0.5M - $10M |

| Genesia Ventures | 14 | Cross-border investments | $1M - $15M |

Sector-Specific Investment Trends

Artificial Intelligence: The Breakout Sector

Vietnam’s AI sector experienced explosive growth in 2024, with funding surging from $10 million to $80 million—an eight-fold increase310. This dramatic expansion positions Vietnam as a leading AI startup hub in ASEAN, with the country ranking second in Southeast Asia for AI startups, accounting for 27% of the region’s total10.

The sector’s flagship success story is AI Hay, which completed a $10 million Series A funding round in July 2025, led by Argor Capital1112. The Vietnamese-developed platform combines generative AI with social networking and has achieved remarkable traction with over 10 million app downloads and 100 million monthly queries1113.

“This investment is an important financial resource to help us build a popular AI tool that reaches every Vietnamese person. It shows the growing trust of global investors in Vietnamese intelligence, in products built by Vietnamese engineers, and in Vietnam’s determination to popularize AI.” - Nguyen Hoang Hiep, CEO of AI Hay14

FinTech: Sustained Dominance

FinTech continues to dominate Vietnam’s startup funding landscape, receiving the most significant investment with a remarkable 249% surge in 202415. The sector’s resilience is evident in its 38% share of total capital invested, up 4 percentage points from the previous year15.

Mobile payment transaction volumes are projected to reach approximately $475.6 billion by 2025, driven by the government’s cashless society initiatives and widespread smartphone adoption16. The P2P lending market is experiencing particularly strong growth, expanding from $570 million in 2022 to an expected $1.7 billion by 202916.

The regulatory environment has become increasingly supportive, with Decree No. 94/2025/ND-CP establishing Vietnam’s first regulatory sandbox for FinTech companies, effective July 1, 20251718. This framework allows firms to test innovative solutions in controlled environments, covering P2P lending, credit scoring, and open APIs17.

AgriTech: Record-Breaking Investments

Vietnam’s AgriTech sector achieved a milestone in 2025 with Techcoop’s $70 million Series A funding round—one of the largest Series A investments in Southeast Asia’s agricultural technology sector1920. The round, comprising $28 million in equity and $42 million in debt financing, was co-led by TNB Aura (Singapore) and Ascend Vietnam Ventures19.

“With this funding, we will accelerate collaborative support for 2,000 cooperatives and agricultural enterprises across Vietnam, targeting export-oriented supply chains while maintaining our commitment to sustainable development.” - Techcoop leadership20

Other notable AgriTech investments include VinaCapital Ventures’ $1 million investment in Koina, an agritech platform connecting farmers with financial organizations and suppliers21, and Touchstone Partners’ seed funding in enfarm, which leverages AI and IoT to optimize crop nutrition22.

| Sector | 2024 Investment (USD Million) | Growth Rate | Key Players |

|---|---|---|---|

| AI & Machine Learning | 80 | 800% | AI Hay, VNG, local AI startups |

| FinTech | 875 | 249% | MoMo, VNPay, Timo |

| AgriTech | 70 | 185% | Techcoop, Koina, Enfarm |

| HealthTech & Education | 210 | 391% | EdTech and MedTech startups |

| Business Automation | 120 | 562% | Enterprise automation tools |

Government Support and Policy Framework

The Vietnamese government has demonstrated strong commitment to fostering innovation through comprehensive policy frameworks and institutional support. Resolution 57-NQ/TW, issued by the Politburo in December 2024, represents a breakthrough strategy for advancing science, technology, innovation, and national digital transformation2324.

The National Innovation Center (NIC), established in 2019 under the Ministry of Planning and Investment, serves as the core of Vietnam’s innovation ecosystem2526. By the end of 2024, Vietnam’s startup ecosystem had grown to over 4,000 startups, including two unicorns and eleven companies valued at over $100 million2728.

“Vietnam has set an ambitious goal to become one of the world’s leading agricultural nations by 2050 and to be among the top 10 global agricultural processing hubs by 2030.” - Le Minh Nhut, Co-founder and CEO of Demeter29

Key government initiatives for 2025 include:

- Enhanced incentives for NIC operations through Decree No. 97/2025/ND-CP30

- Special mechanisms for private sector development via Resolution 68-NG/TW31

- Streamlined business licensing processes reducing startup formation time32

- Increased R&D investment targeting 2-3% of GDP, focusing on AI, semiconductors, biotechnology, and renewable energy33

International Recognition and Rankings

Vietnam’s startup ecosystem has gained significant international recognition, climbing to 55th globally in the Global Startup Ecosystem Index 2025—marking the third consecutive year of improvement3435. The country maintains its 5th position in Southeast Asia, demonstrating consistent progress in enhancing its innovation environment.

Ho Chi Minh City entered the top 5 startup ecosystems in Southeast Asia for the first time, securing 110th globally—its highest ranking to date35. Hanoi climbed 9 places to 148th, while Da Nang made a remarkable leap, jumping 130 spots to 766th, becoming the fastest-growing locality in the country35.

“Vietnam’s startup ecosystem holds significant potential due to its market size, rapid growth rate, and global supply chain shifts. Vietnam is emerging as an attractive destination amidst rising production costs in China and the effective implementation of its free trade agreements with the EU, the UK, and Asia-Pacific countries.” - Eli David Rokah, Founder and CEO of StartupBlink34

Challenges and Future Outlook

Despite the impressive growth trajectory, Vietnamese startups face several challenges that require strategic attention. Access to late-stage funding remains limited, with no late-stage startup funding recorded in the first half of 202436. The ecosystem also needs to develop more sophisticated support infrastructure, including experienced mentors, advisory services, and international market access.

Looking ahead, several trends are expected to shape Vietnam’s funding landscape:

Green Technology and Sustainability are gaining momentum, with increased global attention driving investments in renewable energy, electric vehicles, and carbon management solutions3738. The government’s commitment to net-zero emissions by 2050 creates substantial opportunities for climate tech startups.

Cross-border Expansion is becoming increasingly important, with Vietnamese startups targeting regional and global markets. Companies like VNG, Vietnam’s first tech unicorn, are pursuing international listings and expansion strategies3940.

Corporate Venture Capital is emerging as a significant force, with established Vietnamese conglomerates like Vingroup launching dedicated investment funds to support ecosystem development9.

Conclusion

Vietnam’s funding landscape in 2025 represents a remarkable transformation story—from a challenging 2023 to a record-breaking 2024 and a promising outlook for continued growth. The combination of strong macroeconomic fundamentals, supportive government policies, diverse investor participation, and innovative startups positions Vietnam as a leading innovation hub in Southeast Asia.

The success of companies like AI Hay, Techcoop, and the continued growth of established players like VNG demonstrate the maturity and potential of Vietnam’s startup ecosystem. With sustained investment in R&D, continued regulatory support, and the emergence of new sectors like AI and green technology, Vietnam is well-positioned to achieve its ambitious goal of becoming a high-income, developed country by 2045.

As the ecosystem continues to evolve, the focus on building sustainable, globally competitive companies that can scale across international markets will be crucial for maintaining Vietnam’s position as one of the world’s most dynamic startup destinations.

This analysis is based on data through July 2025 and reflects the most current available information on Vietnam’s startup funding landscape.

Research and parts of this report were done using Perplexity.

Footnotes

-

https://www.vpca.vn/insights/vietnam-innovation-private-capital-report-2025 ↩

-

https://www.bcg.com/publications/2025/southeast-asia-vietnam-innovation-and-private-capital-report ↩

-

https://wowsglobal.com/resources/blogs-insights/may-2025-investment-snapshot-capital-wakes-up-hungry/ ↩ ↩2 ↩3

-

https://nssc.gov.vn/startup-stories/insights/current-state-of-startup-investment-in-vietnam-2025/ ↩

-

https://www.vpca.vn/events/vietnam-innovation-private-capital-summit-2025 ↩

-

https://www.cushmanwakefield.com/en/vietnam/insights/southeast-asia-outlook ↩ ↩2

-

https://fi.co/insight/build-a-great-startup-in-2025-with-the-fi-vietnam-startup-accelerator-hanoi ↩

-

https://techcollectivesea.com/2025/06/19/vc-trends-shaping-vietnams-investment-landscape-in-2025/ ↩ ↩2

-

https://plf.vn/investment-trends-2025-breakthrough-opportunities-from-vietnams-policies/ ↩ ↩2

-

https://vil.asia/vietnam-startups-highlights-of-2024-and-what-lies-ahead-in-2025/ ↩ ↩2

-

https://vneconomy.vn/da-nang-venture-and-angel-summit-2025-opens.htm ↩ ↩2

-

https://wtocenter.vn/su-kien/26854-southeast-asian-economies-face-hard-challenges-in-2025 ↩

-

https://vneconomy.vn/for-sustained-success-of-vietnams-startup-ecosystem.htm ↩

-

https://www.statista.com/outlook/fmo/capital-raising/traditional-capital-raising/venture-capital/vietnam ↩

-

https://www.bain.com/insights/southeast-asias-green-economy-2025/ ↩ ↩2

-

https://vietnamnews.vn/economy/1719505/green-startup-competition-2025-launched.html ↩ ↩2

-

https://www.mckinsey.com/featured-insights/future-of-asia/southeast-asia-quarterly-economic-review ↩

-

https://en.vietnamplus.vn/global-vietnam-business-startup-2025-winners-announced-post321149.vnp ↩ ↩2

-

https://technews180.com/unicorns-soonicorns/vietnam-unicorns-and-startups/ ↩

-

https://wondersea.vn/vn/get-funded-the-top-venture-capital-firms-in-vietnam.html ↩

-

https://theinvestor.vn/vietnams-first-tech-unicorn-vng-targets-record-revenue-lower-net-loss-in-2025-d16086.html ↩

-

https://www.xyzlab.com/post/vc-funds-and-angel-investors-in-vietnam ↩

-

https://theinvestor.vn/vietnams-tech-unicorn-vng-expects-2025-loss-to-narrow-by-47-plans-name-change-d16003.html ↩

-

https://doventures.vc/assets/uploads/reports/download/vietnam-innovation-and-private-capital-report-2025-1747711844.pdf ↩

-

https://jdi.group/top-active-venture-capital-companies-for-vietnams-startups/ ↩

-

https://techcollectivesea.com/2024/07/19/vcs-for-startups-and-entrepreneurs-in-vietnam/ ↩

-

https://www.failory.com/blog/venture-capital-firms-vietnam ↩ ↩2 ↩3

-

https://www.vietnam.vn/en/tuoi-tre-startup-award-2025-voi-chu-de-cung-ai-kien-tao-tuong-lai ↩

-

https://en.vcci.com.vn/funding-halves-for-vietnamese-tech-startups-in-first-half-of-2024 ↩

-

https://www.grantthornton.com.vn/contentassets/8bba73c4a2a34208989b69fef3d07209/ma---vietnam-an-attractive-market-for-private-equity-investors.pdf ↩